salt tax cap removal

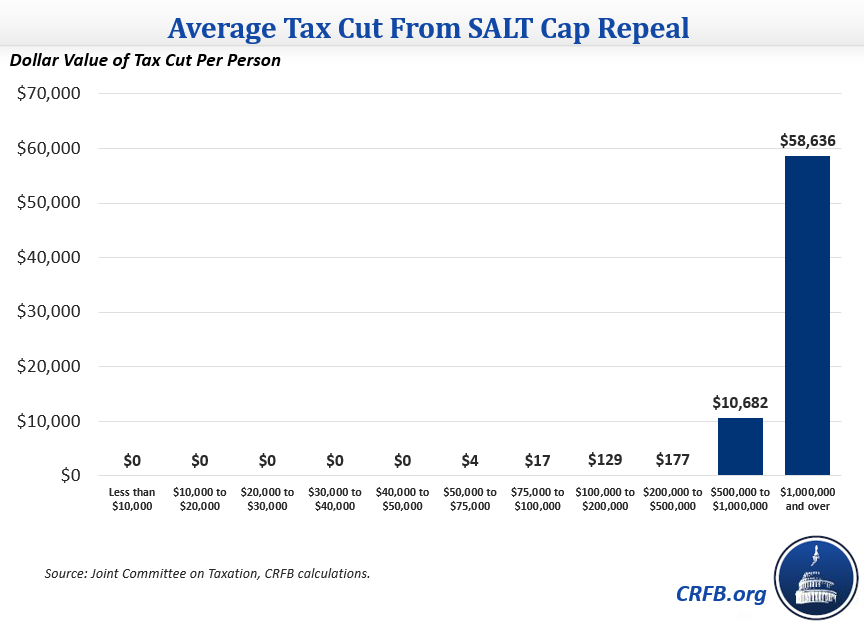

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. Tom Suozzi D-NY pushed for the cap to be moved up to at least 75000 but they.

Porter Backed Bill Seeks To Restore Salt Deductions Capped Under 2017 Tax Act Orange County Register

Soaring inflation costs have led to New Yorks cap on property tax increases to be set at its upper most limit of 2 state Comptroller Tom DiNapolis.

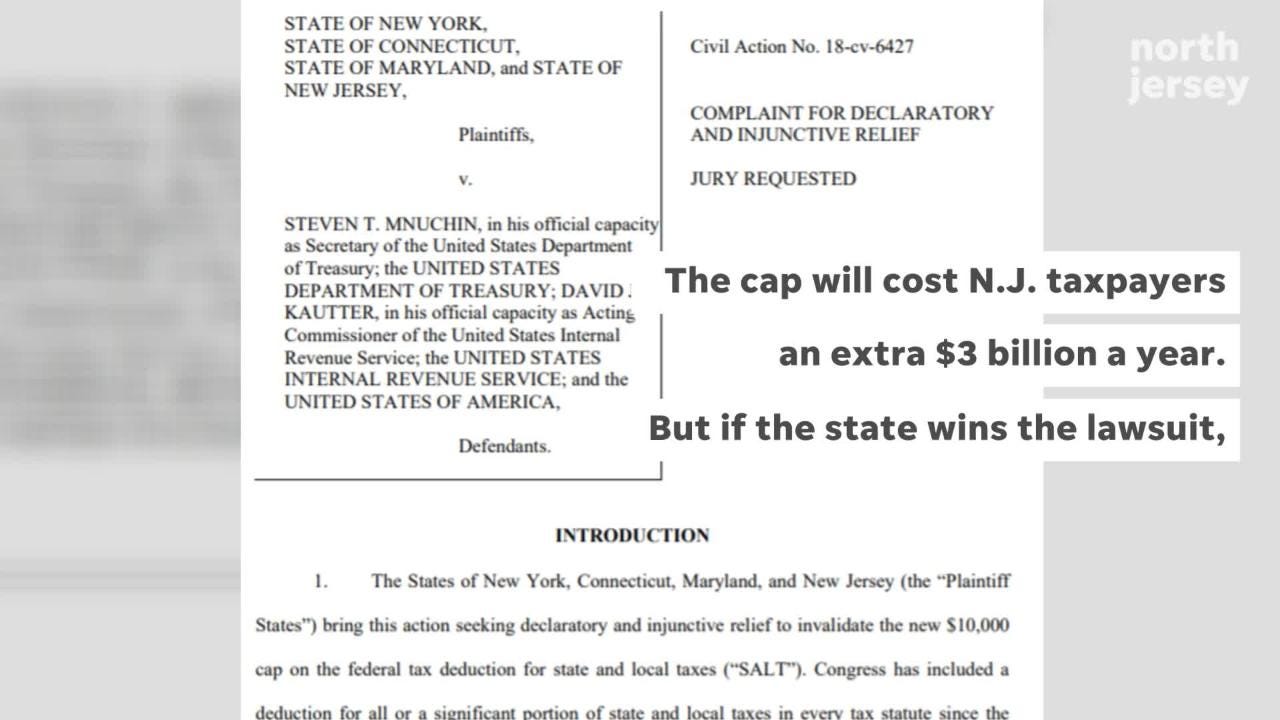

. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. 57 percent would benefit the top one percent a cut of 33100. But you must itemize in order to deduct state and local taxes on your federal income tax return.

The TCJA paired back the AMT reducing the number of taxpayers subject to it from about 5 million in 2017 to 200000 in 2018. The TCJA also repealed the Pease limitation for tax years. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion.

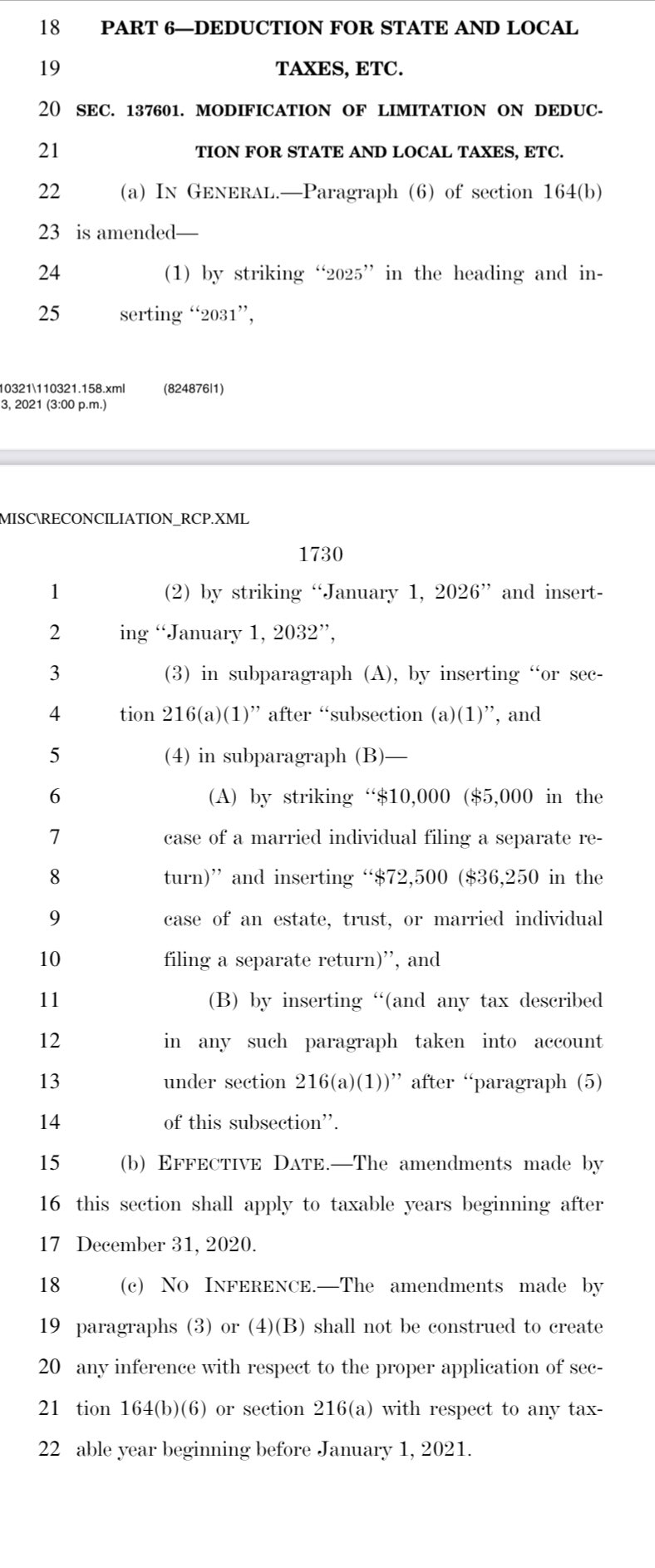

Sales of tangible personal property to Petitioner as a. One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about 400000. The so-called SALT deduction was capped at 10000 by former President Donald Trumps tax reform bill which became law in late 2017.

The SALT deduction benefits only a shrinking minority of taxpayers. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031.

House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the Senate on. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. Tom Suozzi writes For.

Josh Gottheimer D-NJ and Rep. Democrats consider SALT relief for state and local tax deductions. Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

Taxpayers particularly wealthy people in New York. PUBLISHED 122 PM ET Jul. However nearly 20 states now offer a workaround.

As alternatives to a full repeal of the. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress. JVC Junk Car Removal can be contacted via phone at 631 457-0022 for pricing hours and directions.

In the House members of the so-called SALT Caucus Rep. From tax under Section 1116a of the Tax Law receipts from the sale of such service to the exempt organization are not taxable. LaserTouch Aesthetics centers provide laser hair removal tattoo removal Botox and fillers laser skin rejuvenation microdermabrasion cellulite treatment.

JVC Junk Car Removal is located at 122 Peconic Avenue in Medford New York 11763. Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file. The deduction has a cap of 5000 if your filing status is married filing separately.

That figure dropped to 21 billion in 2020.

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Buttigieg Courts High Tax States With Salt Cap Removal Plan Fox Business

Nj House Delegation Calls For Elimination Of Salt Tax Hike

Repeal Of The Cap On State And Local Tax Deduction Still In Play

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Nancy Pelosi Privately Opposes Repeal Of Salt Deduction Cap

/cdn.vox-cdn.com/uploads/chorus_asset/file/22439062/1256311254.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

House Votes To Eliminate Salt Deduction Cap Offering Relief To New Jersey And Other High Tax States

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal State And Local Tax Deduction Tax Foundation

Effort To Restore Full Salt Tax Break Picks Up Momentum In D C Crain S Chicago Business

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Nj House Delegation Calls For Elimination Of Salt Tax Hike

The Price We Pay For Capping The Salt Deduction Tax Policy Center